- Over 93% of all mortgages in Portugal have variable rates, compared with the European average of 15%, affecting 1.3 million families.

- With rising interest rates, foreclosures are expected to rise in 2023.

- Real wages have decreased 4.6% in the first half of 2022, and the wage increases in 2023 will be lower than inflation.

- Rising interest rates will also contribute to increased costs for personal and auto loans.

- Higher inflation and higher energy prices will put additional pressure on savings.

Portugal finds itself in a very challenging environment, as one of the countries in Europe with the lowest GDP per capita, and a soaring real estate market that seems to have no end in sight. While still recovering from the effect the pandemic had on the local economy, due to its over-dependence on the tourism sectors, Portuguese families are finding it hard to keep up with inflation, and rising costs. This coupled with one of the hottest real estate markets in Europe, which prices the average family out of a home is set up to be one of the first European real estate bubbles to collapse.

The supply and demand

The first thing experts say is that house prices in Portugal are high due to low supply, and that is partly true. However, analyzing housing supply and demand is not the same as any other assets. The supply of homes is only represented by the properties listed for sale on the market, and that does not mean that at some point in the future, there won’t be more properties available for sale.

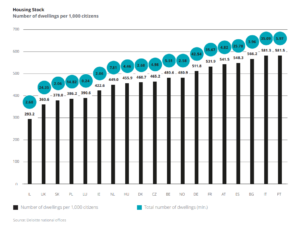

Moreover, Portugal is one of the European countries with the highest number of houses per inhabitant, which stands at 581.5 dwellings for every 1,000 inhabitants.

Source: Deloitte

While most of these properties are not listed for sale, they are also not even being used, and it is estimated that between 730,000 to 750,000 properties are empty. Why?

One of the reasons for this phenomenon is that tenants are having a hard time keeping up with rent payments, with many of them being delinquent. It is estimated that 25% of properties listed to rent are due to an increase in the delinquency rate.

Roughly 8.25% of all the properties listed to rent have tenants that are late on rent for up to 3 months. Around 7% of those properties have tenants that haven’t paid rent in over 6 months.

This, along with a high tax rate of ~28% landlords have to pay on property income, prevents property owners from wanting to rent, which explains why so many properties sit empty without being used.

With the situation in the rental market already fragile as it is, rents are expected to be 5,43% higher in 2023, which will put additional pressure on tenants and landlords. Even with the recent measure approved by the government to limit rent increases to only 2% and reimburse landlords for the difference, the increase will still be felt by nearly ~26% of the population.

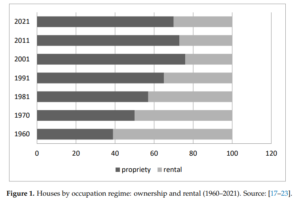

Source: The Dysfunctional Rental Market in Portugal

Moreover, it is estimated that there are 1.1million second homes, and roughly 880,000 are used for short-term rentals. What is alarming about the supply and demand dynamics of the Portuguese real estate market, is that there seems to be an apparent housing shortage, when in fact, the properties are just not listed on the market.

This creates a situation, where a liquidity crisis or a credit crunch could push thousands of properties into the market, since 700,000 homes are not being used, and 1.1 million are just second homes used for short-term rentals. For comparison, the number of houses transacted in 2021, was 165,682.

House prices in Portugal

Since 2015, Portugal’s housing prices have deviated from the EU average. Portugal’s house price increased by 5.9% in 2020, at a slower pace than in 2019. Although the growth is slowing down, even throughout 2021 prices continued to soar.

Source: Eurostat

According to Deloitte, while comparing housing prices on average in the country with the average price in Lisbon the deviation in price is 336%. In essence, it means that a regular citizen would have to pay over 336% higher prices for the same house in the capital compared with the average house prices in the country.

Out of over twenty countries, Portugal shows the highest deviation in reported prices. On average Lisbon and Porto, the second largest city, are 164% more expensive than the national average.

![]()

Source: Deloitte

If we compare it with other countries, Portugal was the only country to have a deviation that exceeded 100%. In second place comes Germany with an average deviation of 77%. The results are mind-boggling, Portugal’s deviation is over twice the amount of Germany's.

In Portugal the average house costs around 24x the annual GDP per capita, but the data is based on the average house price across the country. When we compare with Lisbon where ~27% of the population lives, the multiple would be higher, even considering that average salaries in Lisbon are also slightly higher.

Housing affordability in Portugal

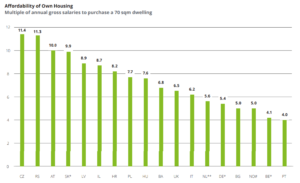

In order to assess housing affordability across European countries, Deloitte calculated the multiple of annual gross salaries needed to purchase a 70 sqm dwelling. Surprisingly Portugal is the European country where it would only be necessary 4 gross salaries to purchase a 70 sqm dwelling. But the data can be misinterpreted because it is calculated according to the country’s average property price.

Source: Deloitte

If we take into account the price of properties in Lisbon, where nearly 30% of the Portuguese population lives. An average person would need 13,44 annual gross salaries to be able to purchase a 70 sqm dwelling.

Given the concentration of jobs in the two major cities, and the high housing prices it is increasingly difficult for Portuguese to afford a house. It is clear the Portuguese housing market, particularly in the two major cities, is highly overpriced and will be susceptible to a correction.

The anatomy of Portugal's housing bubble

There are a few factors that contributed to the formation of the Portuguese housing bubble:

- Credit expansion

- Lack of financial literacy

- Inflow of foreigners

- Low-interest rates

- Lowest mortgage rates in Europe

- Moratorium effect

1. Credit expansion

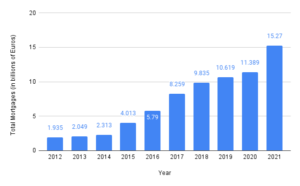

The main driver behind the housing bubble in Portugal was the increase in credit offered to families. The numbers are staggering and explain how the market could not handle so much liquidity and easy access to credit.

Following the Great Financial Crisis of 2008 and the European sovereign debt crisis, Portuguese banks were forced to cut down the credit offered to customers. But since then, the total amount of mortgages and home loans conceded has increased by ~670% over the last 9 years.

Easier credit access and lower interest rates allowed individuals to buy houses and refinance, partly explaining the increased property prices throughout the country.

2. Lack of financial literacy

One of the main drivers of the housing bubble is undoubtedly the lack of financial literacy of most Portuguese families. This is the only explanation for the fact that over 93% of mortgages have variable rates. In a survey conducted across European countries, Portugal appears as the most financially illiterate country in Europe.

Source: ECB

The lack of financial literacy in Portugal is the main reason why most of the mortgages in the country have variable rates. It is enticing to pay lower interest, but most Portuguese families could not consider a scenario where interest rates could rise. Bankers were also incapable of advising families appropriately.

By contrast, across the European Union, the average percentage of variable rate mortgages is 15%, in sharp contrast with the Portuguese reality.

3. Inflow of foreigners

One of the reasons real estate prices have increased is the number of foreigners moving to Portugal, or acquiring properties in the country. As of last year, foreigners represented 10% of all property transactions, and they pay on average 75% more for a house.

The number of foreigners buying properties in Portugal has also decreased in the last few years, and in 2017, they represented 25% of all the real estate transactions and in 2018, they represented 20%.

This was one of the reasons that the Portuguese property bubble formed, and why prices rose sharply even before 2020.

While 10% of all the property transactions is not sufficient to explain the price increases in some areas of the country, it is clearly affecting housing prices in the Algarve, where foreigners represent 40.3% of all the transactions, and 45.8% of the total property value transacted.

Moreover, in Lisbon foreigners represent 23.1% of all the transactions and 35.4% of the total value transacted. Since there is a higher percentage of the transaction's total value than the number of transactions, we can conclude that foreigners are buying the most expensive properties and they are also paying higher sums.

The number of foreigners living in Portugal is today at a historical high. Nearly 500,000 foreigners have moved partially or permanently to Portugal. Not only are they in search of good weather, but also looking for lower taxes.

Portugal has implemented some policies in order to attract foreigners. The non-habitual resident status allows foreigners to have a low tax rate on their foreign income. This is a very attractive way of reducing taxes and has contributed significantly to the increase of foreigners in the country. There is also the gold visa policy that is present in Portugal and some European countries.

For example, Chinese citizens have rushed to obtain a golden visa in Portugal. Portugal grants a five-year residency permit to non-EU citizens who purchase a minimum of €500,000 worth of property. This, in turn, allows them to travel across the Schengen countries, and after the initial five years, they can apply for permanent residency.

The inflow of foreigners has also been contributing to housing speculation. The inflow of foreign capital in the region has impacted prices. With 60% of Portuguese earning under €800 monthly, it has become increasingly difficult to afford a house for the average person.

4. Low-interest rates

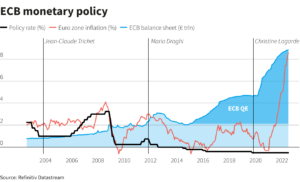

The low-interest rate environment we have been living in during the past few years has also contributed to the increase in house prices. Following the Great Financial Crisis of 2008, governments in Europe were forced to take on additional debt, in order to bail out companies, and impose measures to prevent an even longer recession.

Source: Ercouncil

The increased debt means that the ECB is forced to keep rates low, as a way to stimulate the economy and prevent interest expense on the sovereign debt from increasing to a very high level of GDP.

Inadvertently creating a situation, where reckless spending and overleverage are rewarded with low rates while punishing savers and investors that are unable to generate any returns on safe investments with bonds yielding next to nothing. This partly explains why most asset classes have increased, as savers and investors turn to riskier options to generate returns.

5. Lowest mortgage rates in Europe

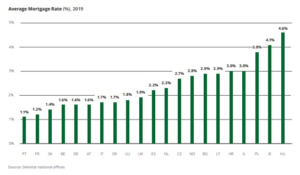

Considering that most of the mortgages in Portugal have a variable rate, Portugal has the lowest mortgage rate in Europe, at an average of 1.1% in 2019, which has declined to 0.892% at the end of 2020, according to the Portuguese National Institute of Statistics.

The low mortgage rates have made headlines, warning of a possible bubble forming in the European housing market. Additionally, this makes any rate increase even more detrimental to families that will have to take part of their disposable income to pay for the increase in their mortgages.

Source: Deloitte

Source: Deloitte

6. Moratorium effect

The government’s solution to the problems caused by the pandemic has been to consent moratoriums on loan repayments. The problem is such that the government has decided to extend the loan repayments moratorium until September 2021.

The total amount of credit under moratorium in Portugal was at its peak €41.5 billion, which was about 20% of GDP in 2020. Only surpassed by Italy with €115.6 billion, and Spain with €57.9 billion.

However, the comparison is unfair, due to the population being much higher in both countries. Italy has 60.36 million people, and Spain has 46.94 million. Portugal has a population of 10.28 million, and if we divide that by the amount of credit in moratorium we reach ~€4,036 per inhabitant. Italy has ~€1,915 in moratorium per inhabitant, and Spain has ~€1,233. Portugal even compared with Italy has over twice the amount of moratorium credit per inhabitant.

We should consider that the average gross salary in Portugal in 2020 was €1,418. Compared with €2,442.00, and €2,279.00, in Italy and Spain respectively. This has led Standard & Poor’s to put out a warning on worsening asset quality across Portuguese banks.

How Portugal’s housing bubble will burst

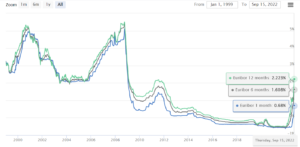

Portugal’s real estate bubble will eventually collapse due to variable interest mortgages that are affected in the short term by increases in Euribor rates.

Since over 93% of all mortgages have variable rates, it is expected that the mortgage payments of Portuguese families could rise by 10% (6-month Euribor) to 17% (12-month Euribor) at the end of year when the Euribor rate reaches 2%. If inflation keeps rising and the ECB is forced to continue to raise rates, we could have a scenario where mortgage payments for some families could increase a lot, depending on the ECB’s expected terminal rate.

Higher than expected inflation remains the biggest risk, which would force the ECB to raise interest rates even more.

Source: Euribor Rates

The government is now well aware of this impending collapse that could put a large percentage of the population below the poverty line, in a country where 1.6 million people, roughly 15.5% of the population are already below the poverty line, and 2.3 million, about 22.3% of the population are at risk of poverty.

The government is preparing an intervention to prevent the collapse of the real estate bubble

The government is considering measures to reduce the effect of higher rates. While it may seem like the best option, it’s nothing more than a short-term fix that has both political and social consequences.

On one hand, there are plenty of individuals who made an effort to prepay their loans, while ~26% of families are currently renting. These individuals will eventually see their taxes supporting other families that were not so prudent, and overleveraged themselves, which can create social unrest, and division.

Delinquencies and foreclosures are expected during the second half of 2023 if inflation keeps rising in the EU, which will force the ECB (European Central Bank) to increase its terminal rate. It is nearly impossible to accurately predict what the terminal rate will be, but considering the current inflation and Federal Funds Rate in the US, and the fact that the ECB is well behind compared to the Fed in terms of adjusting rates, we could expect steep rate hikes in 2023, which inevitably will affect the Portuguese housing market.

Higher interest rates in 2023

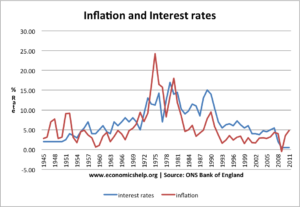

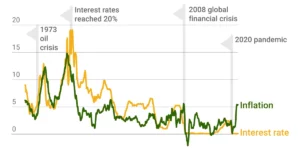

Historically, when looking at periods of high inflation, we can see that it is usually required to raise rates by the same amount or higher than the inflation rate to reduce and control it meaningfully. While this is not so apparent in the short timespan of the last 20 odd years since the introduction of the Euro, looking at other countries such as England and the US it becomes clear.

If we look at the data from the Bank of England, we can easily understand how raising rates moderately when inflation is running high does not meaningfully reduce inflation, which shows that persistent inflation can only be tamed with a very high terminal rate, which poses a risk to the EU, and the Portuguese real estate bubble.

It is clear looking at the US macroeconomic history that inflation rates tend to lower when interest rates are around the same level.

Source: Gzeromedia

This is alarming because the current interest rate in Europe is well below the inflation rate across EU countries, so we can expect further rate hikes towards the end of 2022 and well into 2023. This puts additional pressure on the rates of sovereign debt of some of the most indebted countries in the EU, such as Spain, Portugal, Italy, and Greece.

The ECB will have to increase bond purchases to make sure the bonds of these countries do not reflect their real value. Otherwise, they will be trading much lower. The par value of these bonds does not accurately reflect their value, nor does it reflect the risk of default. This situation can also deteriorate the relationship between northern and southern European countries, and poses a threat to the EU’s future.

While the ECB is working on solutions to address Italy’s rising rates, it will soon have to expand these measures into other countries in similar situations and ramp up bond purchases.

Portugal’s economic situation

An economy built on excessive debt

Portugal is already in a very fragile position, given its 133.6% debt to GDP. It is one of the most indebted European countries, only surpassed by Italy and Greece. Household debt to GDP is also approaching very high levels.

In March 2020, it was at 63.8%, and it has increased to 68.3%. To put things into a historical perspective, the highest household debt to GDP in Portugal was in 2009, at 92.2%.

Consumer credit is also approaching alarming levels not seen since 2009. At the end of 2020, the total consumer credit in Portugal amounted to €25.8 billion.

Source: Global Economy

Mortgage credit in Portugal is also climbing higher. At the end of 2020, it reached €94.95 billion. Considering the GDP of the country in 2020 was around €200 billion, that is nearly 50% of the GDP. Private sector debt, as well as business credit, have all continuously increased.

This alarming scenario has pushed the Bank of Portugal to issue a warning in its recent stability report.

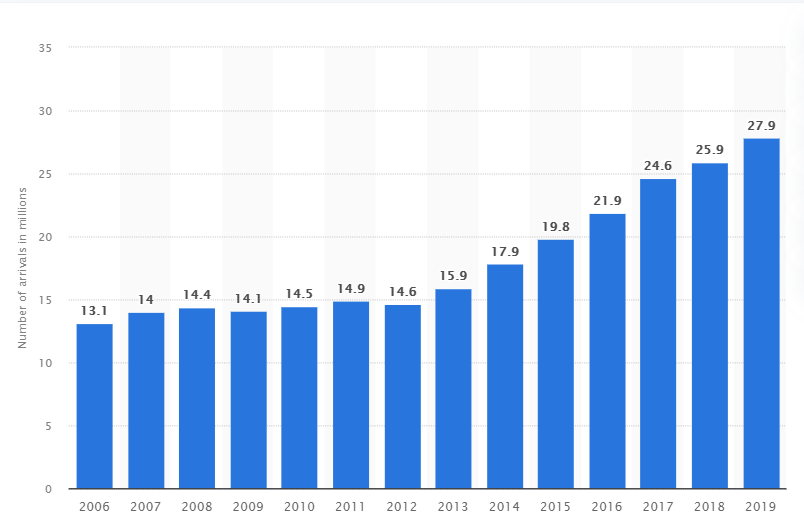

Portugal is over-dependent on the hospitality and real estate market

The country depends heavily on the hospitality and travel industry which represented 19% of its GDP in 2019. On the other hand, the real estate market represents 12% of GDP. The pandemic has put increasingly more pressure on both pillars of the economy, hospitality, and the real estate market.

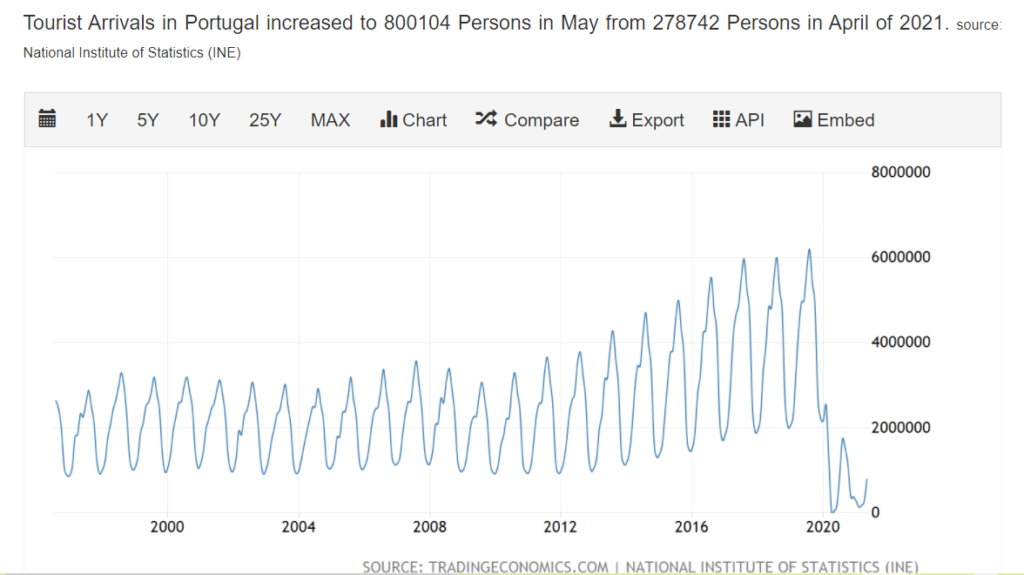

GDP will be materially impacted in 2021 and the following years. If the real estate market collapses, GDP can slide significantly. This overdependence on the two sectors will be Portugal’s and their indirect relation is a risk to the Portuguese economy. Tourism in Portugal has been growing at a fast pace since the turn of the millennium.

Number of tourist arrivals in Portugal

Source: Statista

Source: Statista

With COVID-19, the decrease in tourist arrivals has been felt all throughout the economy. Although it is slowly recovering to previous levels, it is still very far away from what it was in 2019.

Source: TE

Job market

The over-dependence on the hospitality, and real estate sectors meant the pandemic impact was greater than in other European countries. When we look at the data on furloughs, combined with moratoriums, we can see that Portugal was the European country with the largest percentage of workers on furlough.

It also had the highest percentage of credit moratorium among European peers. Over 17% of the active population have been either laid off, furloughed, or had their salaries cut since the pandemic started.

To add to that there were over 400,000 unemployed, nearly 8% of the active population, which has since decreased to ~300,000 or 6% of the active population. Given the country’s fragile position the housing market is expected to go through a sharp decline, once the consequences of Covid-19 start to take effect.

The median net income has seen a meager increase of 4.5% from 2010 to 2017. Only Greece, Italy, Cyprus and Spain had a worse evolution in their median salaries. This is another reason the country remains uncompetitive, compared to its European peers.

The main reason for the lack of growth in the median salary is the fact that Portugal has only been able to grow an average of 0.6% annually over the last 15 years. In turn, over 21% of the Portuguese population is at risk of poverty.

Other factors to consider

Real wages

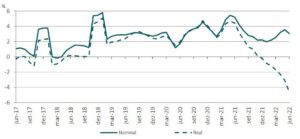

While nominal wages have increased they are not keeping up with inflation, which will continue to erode purchasing power and savings. Real wages, or wages adjusted for inflation, are already seeing a massive decline of 4.6% due to inflation in the first half of 2022, and decoupling from nominal wages.

Source: Eco

Salaries will not be fully adjusted for inflation in 2023, with the annual salary raise expected to be 2% in the public sector, which means a loss of 8% in purchasing power, and an increase of 3.9% for the private sector, which still signals a decrease of ~6% for private sector workers.

Energy

While energy prices have remained relatively low in Portugal compared with most of Europe, due to the under-dependence on Russian imports. Only 9.6% of the natural gas and 6% of the oil used in Portugal was imported from Russia, making it one of the European countries that are least dependent on Russian energy imports. However, with sanctions mounting on Russia, energy imports will naturally increase in cost, which puts additional pressure on the fragile Portuguese economy.

With most European families struggling to pay their energy bills, the inflow of European tourists in 2023 could be lower. The over-dependence on the tourism sectors could seriously impact GDP numbers.

Additionally, the main Portuguese electric provider, EDP, is facing challenges. With the recent drought last winter, the company was forced to buy wholesale energy and ended up losing money in the first quarter of 2022.

This situation could continue, as the government is well aware of the consequences energy price increases could have on Portuguese families.

Recently, Endesa which is the leading electricity supplier to companies in Portugal has reiterated its intention of raising electricity prices, to reflect the current market price. The statement was met with extreme criticism from the government which is well aware of what a 40% increase in electricity prices could mean for families and businesses.

This situation could force electricity suppliers to lose money over the short term, and rising energy prices coupled with a housing bubble could put Portugal into a deep recession, or even a depression.

Lastly, Portugal continues to be one of the most energy-dependent countries in the EU. It is the 11th most energy-dependent country in the EU, with its energy dependence representing 65.3%, which is higher than the EU’s average of 57.5%. While Portugal benefits from its relative independence from Russian energy imports, we will undoubtedly see higher energy prices across Europe, which will eventually impact Portuguese families.

Conclusion

Given the current economic situation globally, in Europe, and with an impending energy crisis, with interest rates rising, Portugal has found itself in a very complicated situation. There are 2 possible scenarios of how the Portuguese real estate bubble could burst.

One of them is that we see prices come down nominally, as interest rates increase and the Euribor rates are adjusted, which increases mortgage payments for families while reducing their savings rate. This will directly increase the cost to repay the mortgages, and monthly mortgage payments, which will reduce the savings and investments of the average Portuguese family.

The second scenario is that we see an even higher increase in the inflation rate and property prices stabilize or keep going up, despite declining in terms of purchasing power, or when compared with other goods and services. This would be an even worst scenario because it would signal hyperinflation, and the ECB’s inability to control prices in the market.

While the second scenario is far less likely than the first, we will certainly see instability in the Portuguese real estate market in 2023, as Euribor rates start to rise.

Since housing is still a very important component of the Portuguese GDP, due to its indirect relationship with tourism and hospitality, and the construction sector, it is not unforeseen that certain companies which hold an important position in the Portuguese economy could face the risk of bankruptcy. Non-performing loan ratios should spike, and foreclosures will be expected. With the deterioration of asset quality across Portuguese banks, it is possible that we see a banking crisis directly caused by the collapse of the Portuguese property bubble.

It is also important to understand that rising rates not only affect the housing market, but also other parts of the economy. A large percentage of auto loans, personal loans, and business loans are indexed to Euribor rates, which will put even more pressure on the already fragile Portuguese economy.

It is easy to understand that if demand for properties in Portugal slows down, there will be an oversupply of properties. If real estate investors want to sell, the market can be easily flooded with properties given that more than 700,000 properties are completely empty, and there are 1.1 million second homes which 80% are used for short-term rentals. This in turn will put pressure on the prices, which should collapse over time.

If several investors make a run for liquidity, supply will easily outweigh the demand. If it happens, a new lower price will have to be established so that supply and demand are in balance. The European housing market has been soaring over the recent past, so much so that some experts are advising caution and are concerned that the effects of the pandemic might take some time to materialize.

In the worst-case scenario, Portuguese banks could see their NPL (nonperforming loans) increase affecting their liquidity, and creating a domino effect that could put the Portuguese economy on the brink of recession, or even a depression. If so, Banks will turn into real estate agencies, and bankers will turn into realtors.

While 74% of Portuguese families own their own house, and 61,6% of homeowners have paid off their mortgage and own the house free of debt, it is undeniable how higher interest rates are going to affect ~2.93 million people who currently own their house and are still paying their mortgage.