Flanigan’s Enterprises (NYSE American: BDL) is a business focused on liquor stores and restaurants, operating out of South Florida. The total insider ownership is roughly 40%. Peter Lynch mentioned how important it is to focus on stocks with high insider ownership. As the owners will have a vested interest in the business success.

Flanigan’s is a relatively uncovered stock that doesn’t attract the interest of Wall Street analysts. This actually presents an opportunity for investors willing to dig deep into its financials. Let’s dig into the numbers.

Source: Author/Google

Flanigan's Locations

The locations are divided into two segments: restaurant and liquor stores. Some of the restaurants also sell package liquor. In total the company manages 27 locations. Roughly 63% of them are fully owned and the remaining are managed by the company and fall under limited partnerships. There are also five franchises from which the company collects royalties. On average 3% of gross restaurant sales and 1% gross liquor sales.

Source: 10-K

Flanigan's Revenues

Although the restaurant business was highly impaired by the forced lockdowns and the pandemic. Flanigan has managed to post solid results despite the adverse environment. With total revenues dropping only 2.8%. One of the reasons was the increase in the takeaway segment, driven by third-party companies. Management focused on the digital sales segment, with online ordering. A Flanigan’s app was also created in an effort to increase revenues. Still, there was a decrease in the restaurant segment that was offset by the increase of 36% in the package goods, or liquor sales.

Source: 10-K

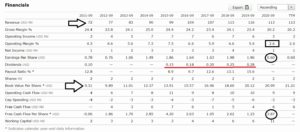

Earnings for 2020 came in at $0.6 per share, down nearly 70% YoY. This was the lowest recorded earnings for the decade. It prompted management to halt the dividend. Which the company has been paying consistently since 2015. It should be noted that from 2015 until 2019 management has been able to nearly double the dividend. While maintaining a conservative payout ratio under 15%.

Source: Morningstar

Balance Sheet and Debt

Flanigan’s increased debt to improve liquidity to manage the adverse effects of the pandemic. Long term debt rose 91.3% to $21.229. Although the total debt rose, the current cash and equivalents the company holds is enough to pay down all of its debt.

Source: 10-K

Most of the debt came from the PPP program, part of the government’s plan to help out businesses during the pandemic. These loans carry a 1% interest, much lower than the average interest on most of its mortgages. And they will mature in two years, May 2022.

Source: 10-K

When looking at the debt maturity for the company we can see there is a disproportionate amount of debt maturing in the next year, attributed to the PPP loans.

Source: 10-K

Flanigan's Management

Given the adverse conditions the pandemic has created it is very insightful to see how management handles it. Flanigan's was naturally affected and forced to reduce their workforce by 3.5%. They were also forced to reduce the salaries of non-executive staff by 20%.

Source: 10-K

In the midst of all of this, the COO and CFO salaries were reduced by 50%. The most remarkable aspect was that the CEO and largest shareholder for the company renounced its salary during the period. James G. Flanigan, the CEO is much more concerned about the future of the company than its short-term salary. In a moment where most CEOs of large corporations gave up less than 10% or nothing at all. This shows the importance of analyzing stocks with high insider ownership, where management and shareholders' interests are completely in sync.

Flanigan's Valuation

At a market cap of $45 million and with a cash position of nearly $30 million. Roughly 66% of the market cap. The stock seems undervalued under $25 per share. Even taking into account the earnings from the previous year which were the worst in the last decade.

It is unclear how the earnings will be by the end of 2021. But it is fair to assume that by the end of 2022 the earnings will be no less than $1.5 per share. Therefore, the company should easily improve earnings going forward around the levels of 2018 and 2019 - Above $1.9 per share. Which gives it a forward price-to-earnings around 12. Price to sales is currently 0.4, and price-to-book at 1.15.

Tailwinds

Return to Normal Activity

Vaccines are being administered at a fast pace in Florida. Economic activity should return to normal. Earnings per share are bound to return to normal levels, at least by the second half of 2022. In the same way, margins were the lowest of the last decade, along with earnings. Should see an improvement going forward, which will boost the earnings

Miami Migration

There has been a recent surge in the number of people and corporations moving into Miami. Seeking tax benefits and loosening lockdown restrictions. From Silicon Valley techs to Wall Street funds. Elliot Management, led by Paul Singer is relocating headquarters to Miami. Along with them Icahn Enterprises (NASDAQ: IEP) led by Carl Icahn is also moving. Citadel and Blackstone are opening major offices in Miami. Even Goldman Sachs (NYSE: GS) is considering moving part of its operation to the region. Softbank is targeting a $100 million investment in tech start-ups based in Miami, which may soon become Silicon Valley 2.0.

This has led real estate prices in the region to surge as much as 25% in the last year. As billionaires and high-level executives bid up real estate prices. These are all excellent news for Flanigan’s, as the higher inflow of people and investments in the region can boost revenues. At the same time, the increase in real estate prices directly benefits the properties it owns even if they are mostly commercial.

Risks

Going Private

Given the high percentage of insider ownership of nearly 80%. It is possible at some point in the future that insiders might try to take the company private. This is a common risk among small caps with high insider ownership.

Regional Exposure

When a company operates at a national or even international scale, the risk of geographical exposure is relatively small. Compared with a small company like Flanigan’s, where the financial performance is directly correlated with the local economy.

As of the 26th of January, Florida’s unemployment was 6.1% according to the US Bureau of Labour Statistics. Which is mainly attributed to the high exposure to the leisure and hospitality sector. Slightly lower than the national average of 6.7%. Despite that, prior to COVID-19, Florida has been among the states with the highest GDP growth.

Final take

Flanigan’s is a solid business that has performed well even in a very unfavorable year. Management has proved in the past that can handsomely reward shareholders. Its views are completely aligned with its shareholder. 2020 was the worst performing year of the last decade for Flanigan’s. The company remained strong and was still able to post a strong result.

Management has done a terrific job managing the pandemic situation, despite the hardships. Once things return to normal, it is expected that Flanigan’s will improve its financial results. The Miami migration movement is a clear tailwind that could help boost revenues, and increase the value of Flanigan’s commercial property portfolio.

At under $25 per share, the stock seems slightly undervalued. The expected recovery is starting to be priced in. I won’t take a position but will closely monitor the price action and its future financial results. The company seems solid, with an interesting business plan, and great management.

We have no position in any of the stocks mentioned. Read our disclosure.

Featured image source: Youtube