Stocks and bonds are two of the most common investment vehicles, but there are significant differences in the advantages and disadvantages of each one. So, what are the differences between stocks vs bonds?

The main difference between stocks and bonds is that stocks give you ownership in a company, which you can benefit from when the company becomes more valuable or distributes profits. Bonds on the other hand pay a fixed interest to the bondholder, and a bond investor is essentially loaning money to an entity in exchange for the interest payments, and to receive the principal at maturity.

However, there are plenty of more important differences that we will highlight in this article.

What is a bond?

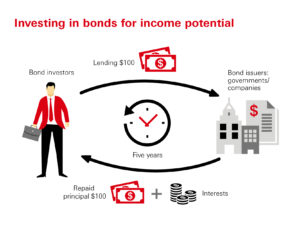

A bond is simply a loan. Companies have different ways of raising capital for different needs. They can issue bonds, ask for loans or issue shares. When you buy a bond you are essentially loaning your money to a specific company, organization, or government, in the case of treasuries.

In the case of the government, they can raise money by raising taxes or issuing treasuries also known as government bonds. Investors loan their money with the promise to receive interest payments on their principal until maturity.

What is a bond coupon?

The interest paid on bonds is commonly referred to as a coupon. Coupons will be paid until maturity when the principal returns to investors. Bonds offer a wide option of maturities depending on the type of bond you invest in. They can range from multiple decades, to short-term maturities under 6 months. Once a bond reaches the maturity date, investors receive their principal back.

How bonds work

Source: HSBC

Source: HSBC

Bonds are traded in markets just like stocks, and in fact, the bond market is actually larger than the stock market. The bond market connects bond issuers and investors allowing entities to borrow money and allowing investors to invest in bonds by loaning these entities money, in order to receive interest.

Fluctuations in their prices will often be affected by company results, and how a particular economy is doing, in the case of sovereign bonds. As for countries, the economic data will often have the biggest impact on the price of their bonds.

What is the face value of bonds?

Bonds are issued with a face value/par value, which means that they are issued at a certain price, and they pay a fixed coupon rate. But given the fluctuations in the bond market, the price of the bond may go down or up. The coupon which is fixed moves inversely to the bond price. Each time the bond price goes down, the coupon or the interest paid will be higher.

The face value, often referred to as par value represents the amount of principal the issuer of the bond will pay back to the bondholder. Since bonds are issued at a certain price, and with a fixed payment. It becomes easy to compare them historically using their issuing price as a comparison. Bonds are sold along with stocks on the open market.

What is a stock?

Have you ever wondered how you can invest in a company? Well, stocks are the best way to invest in a company. When you own a stock you own part of a business. Stocks represent shares of a company, and by buying shares, you essentially buy part of the ownership of the company.

The stake you have in the company is determined by the number of shares you own. They are not lottery tickets as Peter Lynch once said.

Stocks represent equity in the business and allow investors to benefit from the company’s success. Investors in stocks make money when the companies they invest in perform well. When this happens the stock can either increase in price, or the company might choose to distribute its profits among shareholders through dividends.

If the company performs poorly, the value of its stock will decline, and this could mean that your shares will be worth less, and the company might not distribute profits, and in fact, it might even lose money.

What is the market capitalization of a company?

The market capitalization of a company represents the total value of the company in the stock market, and it is usually one of the first metrics investors look at. Market capitalization is calculated by multiplying the total amount of shares times the price per share.

It allows you to understand how the company is valued as a whole, by the market.

What drives stock prices?

There are a few main factors that influence stock prices, that are important to know so we can understand the risks associated with stocks. Here are some of the main ones:

- Company’s estimates

- Current earnings

- Emotions

Company’s estimates

Stock prices tend to fluctuate based on how market participants perceive the future ability of the company to generate profits. Oftentimes analysts following the company will make projections on the future profits of the business, and companies also have their own estimates.

These projections tend to affect the stock price the most. So if a company is expected to grow its profits investors will be willing to pay a higher price for the stock, this will usually push the stock price higher.

Conversely, if the company’s earnings are expected to decline, it is likely that the stock price will go down. This means that stock prices are always directly related to the business's ability to grow its earnings.

Current earnings

Apart from the projected ability of the company to generate profits, the current earnings are also an important factor that influences stock prices. If a company presents great financial results for a given quarter, its stock price will increase.

If the company loses money, investors are more likely to doubt its ability to generate profits in the future, and the stock will go down.

What is the main difference between bonds and stocks?

The main difference between stocks and bonds is that as a bondholder, you will not benefit directly from the company’s performance. You’re simply loaning money in exchange for a fixed interest payment. That is why bonds can often be referred to as fixed income.

No matter how great or awful the company’s results are, you will be paid your coupon rate. This is one of the reasons bonds usually carry less risk than stocks.

Being a bondholder has many similarities to being a bank. Obviously, banks face different risks due to their intricate operations, but their number one risk is loss of principal. If customers stop paying their loans and default on the debt, banks are in trouble. The same thing happens with bondholders.

When you purchase a bond, your biggest risk is not being able to recover your principal. Despite the risk, you should conduct a careful and deep analysis before buying. Understanding the country or organization you are loaning money to, is essential to determine if they will pay you back.

Having a good assessment of the financial numbers behind the institution is a great way to prevent risk when buying bonds.

If you invest in a stock and the company continuously performs better, and it is able to generate higher profits, as a shareholder you will benefit. The stock price will likely go up, which means you are able to generate a profit, and the company is also likely to distribute some of the higher profits. However, the main difference is the risk associated with stocks and bonds.

If the company’s performance deteriorates, the stock price can go down and you might experience a paper loss. The profit distributions might be cut, or even halted. This is the main reason why stocks are far riskier and more volatile than bonds.

Risks of bonds

Source: Provid

Here are the main risks of bonds:

- Interest rate risk

- Re-investment risk

- Duration risk

- Liquidity risk

- Inflation risk

- Event risk

- Default risk

Interest rate risk

Interest rates can affect bond prices, and therefore they are considered a risk. Depending on the interest rate at the time, the bond price will vary accordingly. In most cases when interest rates rise, bonds tend to lose their value because investors can now invest in bonds that pay a higher interest. Conversely, when interest rates are lower, the value of bonds tends to go up.

Re-investment risk

Another important risk to consider in bonds is the re-investment risk. While you are receiving the interest payments, you might not be able to invest that cash flow into bonds that pay the same coupon rate. Investors might be forced to invest in bonds that generate a lower coupon rate.

Duration risk

Duration risk represents the way interest rates will affect the value of the bond. As we explained earlier interest rates can have a great influence on the price of the bond, and the maturity date will also influence the price. Longer duration bonds tend to have larger movements in price when the interest rates change.

Liquidity risk

Similar to stocks, bonds also have liquidity risk. For bondholders to be able to sell their bonds, they will need to have a market with a consistent volume traded. If the liquidity is low, the bid-ask spread may be higher, or might not even be able to trade the bond. This is yet another bond risk to consider

Inflation risk

Inflation will also have an impact on the price of bonds. When inflation is high, bonds tend to lose their value, because they might not be able to keep up with inflation. In a scenario where inflation is higher than the interest, you receive from the bond you are essentially losing money.

Event risk

The event risk represents the possibility that the issuer of the bond will miss the scheduled interest payments. If this happens the value of the bond will decline, and rating agencies will be forced to lower the credit rating of the entity that issued the bond.

Default risk

Finally, the most important risk to consider when investing in bonds is default risk. This represents the possibility that the bond issuer might not be able to pay back its principal in full to investors.

How credit ratings affect bond risk

The risk in bonds varies according to the creditworthiness of the institution issuing the bonds. Government bonds usually offer a low risk, since it is highly unlikely that a country would default on its debt. Government bonds are usually considered risk-free assets. Given the unlikeliness of bondholders losing their principal.

Some companies are well established, their financial history is more consistent, and they also offer bonds with very little risk. Stocks deemed blue-chip are usually seen as reliable, consistent, and with an excellent reputation. These companies, often larger in size and in market cap, offer more security to their bondholders.

Given their long history, and long track record that spans many years, they offer little risk. However, the less risk a bond has the lower its coupon or interest payment will be.

How do rating agencies classify bonds?

Rating agencies will often define the credit rating of different institutions. From companies to countries, rating agencies will evaluate the numbers behind each bond offering. Calculating the risks associated with each specific investment. Companies and countries are then rated, according to their ability to pay back the principal.

Why bond coupons are different?

The coupon rate reflects the risk of the bond, the higher the coupon rate the higher the risk of losing your principal. That is why investors are willing to receive a lower rate, for the safety of knowing they will receive their principal.

Some bond investors are willing to face more risk, and they are rewarded with a higher rate. Institutions with lower credit ratings will in turn have to pay a higher coupon rate, in order to attract investors to buy their bonds.

Bonds are also evaluated by rating agencies, and it is one of the main metrics bond investors follow.

Can you lose money on a bond?

Losing money in a bond is also possible, if the company goes bankrupt, or if it is unable to pay its interest or the principal back to investors. However, in case of bankruptcy, it is more likely for shareholders to lose more money than bondholders. This is because bond investors have priority when claiming the company’s assets.

Risks of stocks

Source: Ocfunds

Here are the main risks of stocks:

- Stock-specific risk

- Macroeconomic risk

- Stock selection risk

- Systemic risk

- Liquidity risk

Stock specific risk

Stock-specific risk represents the company’s individual risks, which are related to its business model, competitive advantages, management, and the sector they are in.

Macroeconomic risk

Macroeconomic risk relates to macroeconomic changes that might affect the company, and could ultimately affect the stock price.

Stock selection risk

For investors that pick their own stocks, their process can also impact their returns, and it remains another risk associated with stocks that you should consider. Stock selection only applies to investors who follow an active portfolio strategy, while passive investors have a lower stock selection risk because they are more diversified.

Systemic risk

Systemic risk represents the possibility of the market as a whole crashing, which would affect your stock prices. The risks stock investors face if the economy collapses are far greater than bondholders.

Liquidity risk

Liquidity represents the number of shares traded on the open market, and it should be considered a risk because if there is no liquidity investors are unable to trade their shares.

Why is a bond safer than a stock?

The main reason why bonds are safer than stocks is that bondholders are preferential creditors, and in the event of a bankruptcy, they will receive compensation before stockholders. This means that bondholders will always be paid first before shareholders have any claim to the company’s assets.

Are bonds safe if the market crashes?

Another risk to consider is when the market crashes. No matter how well constructed your stock portfolio may be, there is always a systemic risk like a crash. Stocks are unpredictable and market timing is extremely difficult. This is something to take into account if you are thinking of investing in stocks because the value of your portfolio can fluctuate a lot.

Despite carrying more risk than bonds, stocks are ultimately the best-performing asset. Bonds tend to be safer than stocks, but stocks are also more likely to generate larger returns, especially in the long run.

Comparing stocks vs bonds

What are the advantages of bonds?

- Safer

- Less volatile

- Stable returns

What are the disadvantages of bonds?

- Lower returns

- No benefit from the company’s performance

What are the advantages of stocks?

- Higher returns

- Benefit directly from the company’s performance

What are the disadvantages of stocks?

- Riskier

- More volatile

- Unstable returns

By comparing bonds and stocks, we can see the correlation between risk and return. Bonds carry less risk in general and have lower expected returns. Despite being riskier, stocks offer the possibility for higher returns.

Combining stocks and bonds in a portfolio

Some investors advocate for a portfolio of both bonds and stocks. One of the most popular is the 50/50 stocks and bonds. Meaning an investor’s portfolio should have half of it in bonds and the other half in stocks. This will reduce market risk, but can also reduce your potential returns.

Others advocate for the age rule. Meaning that the percentage in bonds should be proportional to our age. It is based on the idea that as you grow older you should prefer assets that carry less risk. Investors are willing to invest in riskier assets, as long as the expected returns are higher, but as we grow older we tend to prefer safer assets.

Similarities between stocks and bonds

According to Warren Buffett, stocks are in essence bonds with a fluctuating coupon. When you buy stock of a company, you are essentially expecting the company to generate earnings while you hold the stock. In theory, you need to analyze stocks so that you can predict the coupon the stock will pay or the return the company will generate.

Should you invest in bonds or stocks?

Before choosing to invest in stocks or bonds you need to understand your risk tolerance and your investment horizon.

It is important for you to understand the risks you are willing to take, and which investments work better for you. You could earn a small coupon rate nearly risk-free, or you can aim for higher returns and the risk that comes with it.

Stocks have higher volatility than bonds, which reflects their higher degree of risk, but they generate higher returns.

Remember that the company’s performance is directly correlated with its stock price. The same does not happen with bonds. If the company’s prospects remain positive, the stock will appreciate in price. If for any reason those future estimates are not met and the company’s operations deteriorate, the stock price will eventually tumble.

Which is better bonds or stocks?

While stocks offer greater returns, they also come with higher risks. Bonds, on the other hand, are a safer place for your money but the returns will be lower. Both stocks and bonds are two different asset classes that have a distinct profiles. Investors can also own both in a diversified portfolio.

Conclusion

As an investor, you should be aware of the risks associated with both stocks and bonds. Being aware of the risk and taking the right precautionary measures to control and reduce it is key to being successful in the markets.

With that in mind, you should research every investment opportunity thoroughly, to ensure you make the most informed decision possible.