With the current overvaluation in the market, investors are still asking themselves whether overvalued stocks are still worth it. Although we have seen stock valuations come down, there are still some stocks that remain that have inflated valuations, that might not decline for a long time.

In this article, we will analyze whether or not you should be investing in overvalued stocks, and if it is still worth it.

Are overvalued stocks bad?

Overvalued stocks are not bad per se, but they do carry more risk than a fairly valued or even undervalued stock. The reason is that overvaluation is just a way of pricing in extremely positive expectations for a certain stock. Over time if these expectations do not materialize, the valuation needs to come down significantly.

This is one of the reasons why buying stocks with a price-to-earnings over 30 puts a lot of pressure on the company to perform. When you buy an overvalued stock, everything needs to go exactly like planned, and sometimes that does not happen.

Should you buy an overvalued stock?

It depends on the specific stock, and the price and valuation. Some high-quality companies are certainly worth a higher valuation, however, you need to make sure that the company has a competitive advantage, and will continue to grow over time.

If it fails to do so, the stock price is bound to decline, and the overvaluation might move closer to the stock's intrinsic value. This rerating is a simple adjustment of the expectations by the different market participants.

Another factor to consider is that overvalued stocks can be more volatile, and decline on bad news. Since the market consensus around that stock is so positive, any negative news can really impact its valuation.

Overvalued stocks can become even more overvalued

Although you may think that an overvalued stock cannot become even more overvalued, this is not true. In fact, as stock prices move upward, new investors will try to profit from this friendly trend.

As more and more investors continue to buy the stock, the trade becomes crowded. This can lead the stock price to increase exponentially. This has happened several times in the past, and it has been one of the defining aspects of the dot-com bubble.

Dot-com bubble

With the widespread use of the internet during the late 90s and early 2000s, the stock market changed completely. New companies were pursuing IPOs every day. Investors’ appetite for tech and internet stocks was at a peak.

Thousands of stocks that were still unprofitable, and with unproven business models were still seeking investors’ money. Investors excited with the possibilities that the internet would bring to businesses started frantically buying every tech stock they could lay their eyes on.

This led to a massive bubble, that would later implode, with some of these high-growth stocks crashing by more than 90%.

Although some of the darlings of the tech bubble were already overvalued, that did not stop them from getting even more overvalued.

After the dot-com bubble some stocks never returned to the crazy levels achieved during the mania. This shows how dangerous it can be to buy overvalued stocks left and right, without considering the valuation and what can go wrong.

Emotions drive the narrative

Although fundamentals should drive stock prices, the fact is that most of the time investors’ emotions are the only driving force behind the price action of certain stocks. Additionally, FOMO or fear of missing out can also explain why some stocks reach very high valuations and become overvalued.

Emotions are one of the key drivers of how investors perceive a stock’s valuation. It is also common for a stock that continues to rise, to see an increasingly higher number of investors piling into the same trade.

Even if the price declines slightly over a one-week period, they might feel that the company is undervalued, since it is trading at a lower price than the previous week.

Is it OK to buy overvalued stocks?

It is ok to buy an overvalued stock, but it all comes down to which stock you are buying. An investment in an overvalued stock only makes sense if there is further upside. Therefore you need to do your due diligence thoroughly, to make sure that you are not overpaying.

The company should be able to continue to grow, and if possible even grow faster than what analysts are expecting. If you are able to find such a stock, then it makes sense to invest in it.

Always consider the risks associated with investing in overvalued stocks, so that you can avoid making a mistake. Here are some of the most common risks when it comes to overvalued stocks:

Overpaying

Overpaying is probably one of the most common investing mistakes. When investors are not familiar with how to value a stock, they tend to overpay for it.

What ends up happening is that you pay a higher price than what the company is actually worth, and it may take years before your price matches the fair valuation of the company. This leads us to another disadvantage of buying overvalued stocks - you need to know how to value a company.

If you don’t know how to value stock steer clear of overvalued stocks

Inexperienced investors are often the ones that get caught in value traps. Since they do not have the required knowledge to accurately value a company, they are better off not even considering overvalued stocks.

Obviously, there are ways to avoid value traps, but you need to be an experienced investor in order to do it.

Management compensation based on performance

When a stock gets overvalued, management might have incentives based on the company’s performance. This may force them to make decisions that ultimately benefit themselves, just based on the stock price.

Although stocks going up in the short term is great for both shareholders and the management, decisions are maybe not be taken in the best interest of the company and its shareholders. When management has a stock performance incentive, they might feel like they need to make decisions and take the actions necessary to push the stock price even higher.

This creates a conflict of interest between the management of the company and its shareholders. Although the stock price might climb higher, it could also be a great risk going forward.

Overvalued stocks need to have a perfect performance

In order to justify the high valuation, an overvalued stock needs to perform exceptionally well. Even the most conservative estimates must be met in order to justify the valuation. This is what carries the most risk when it comes to these type of stocks.

Not everything always goes according to plan. It is common for companies to not achieve their estimates, and to go through rough times. There is no problem with it if a stock is undervalued or fairly valued. However, when a stock is overvalued, any bad news or rough times can push and slash its valuation.

This is because analyst and investors will readjust their projections for the new reality.

Is it better to buy undervalued or overvalued stocks?

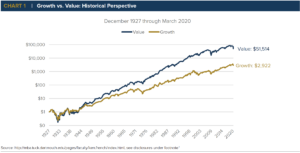

It tends to be better to buy undervalued stocks since historically value stocks have outperformed growth stocks.

Source: Anchor Capital

This does not mean that some growth stocks are not investable, or that you should always invest in undervalued stocks. There are periods where growth socks will outperform and beat the broader market. However, over a long period of time, value stocks are expected to perform better than growth stocks.

Why is overvaluation bad?

Overvaluation can be bad if investors overpay for a particular stock. Additionally, an overvalued stock needs to constantly perform in line with the financial estimates. Failing to do so, can put the valuation at risk of dropping.

Overvalued stocks also tend to have very positive estimates that are not always easy to meet. If the company is not able to deliver the expected results the stock price can drop.

Is overvaluation good?

If we look at it in another way, overvaluation always tends to be a very positive sign for a company. It means that the market consensus views the company favorably. It also thinks it will continue to grow at a fast pace.

High-quality companies with wide moats will also tend to be overvalued, which is just a way of showing how much investors desire the stock. Although overvaluation can be bad, it is not always a bad sign when a company is overvalued.

When should you buy overvalued stocks?

Buying overvalued stocks requires a good ability to value the company, and the right timing. Valuing the company is absolutely crucial because you want to avoid overpaying for the stock, while also having a margin of safety.

This is where timing comes in. Although time in the market beats timing the market, the best way to invest in overvalued stocks is to wait for a decline. When you see the stock going down in price with no apparent reason, and without any fundamental changes that are when you should buy.

Conclusion

Overvalued stocks tend to be a double-edged sword. On one hand, they always tend to be high-quality companies, that are growing a lot and are obviously attractive investments. However, things do not always go according to plan, and one of the most common ways of losing money in the market is by buying overvalued stocks.

Whenever you are thinking of buying an overvalued stock just consider the valuation and what can go wrong with the company. If something goes wrong, is the valuation still justified? Doing this can help you avoid overpaying for a stock.