Silver Thursday remains until today one of the craziest days in commodity markets, which served as a lesson in greed and the risks of attempting to corner a market. To this day, Silver Thursday remains a notorious date to be remembered not only by silver traders but the entire stock market scene in the world as a stern reminder of the dangers of falling down too deep in the rabbit hole. In this article, we will analyze how the Hunt Brothers cornered the silver market and the events that led up to Silver Thursday.

While the Silver Thursday ended on a rather disastrous note for its perpetrators, the legacy of this day continues to survive up to the current century.

What’s Silver Thursday All About?

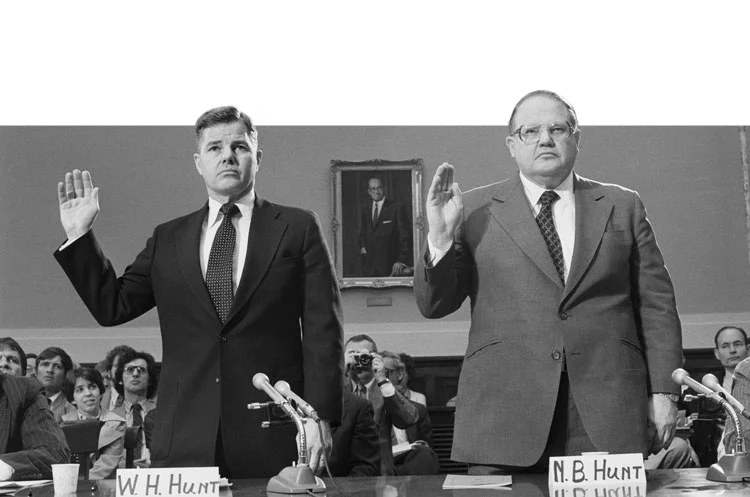

The main three people whom the Silver Thursday event revolved around were Nelson Bunker Hunt, William Herbert Hunt, and Lamar Hunt — also known as the Hunt Brothers. The Silver Thursday issue came about when the Hunt Brothers made a failed attempt to corner the silver market for their own benefit.

Basically, to corner a market, an entity (or in this case a group of brothers) will have to capture a major portion of the supply of the total market for a particular commodity — which in this case was silver.

By taking control of a large part of the entire silver market, the Hunt Brothers had the power to dictate the movement of the commodity itself. Of course, this is prone to abuse — one of the most dangerous moves that can come about the cornering of a market is price manipulation.

Meaning that the Hunt Brothers could have raised or lowered the price of silver as they so wish.

Eventually, the Hunt Brothers’ scheme to corner the silver market was put to a stop — but the damage was already done and the aftermath of Silver Thursday was also a memorable event in itself.

Who Were The Hunt Brothers?

Haroldson Lafayette Hunt Jr., an oil tycoon and the father of the Hunt Brothers who died in 1974, left behind a huge fortune to the brothers amounting up to the billion-dollar threshold.

Similar to how their father risked fortune upon fortune to reach his status, the Hunt Brothers followed in his footsteps by daring to enter the silver market.

How Much Silver Did The Hunt Brothers Buy?

To corner a market, a lot of money and resources would have to be exhausted by an investor (or investors) in order to “dominate” and earn the majority status by force. And so, the Hunt Brothers stretched their efforts out to their limits in order to accomplish their silver-cornering schemes for good.

The total recorded amount of silver purchased and acquired by the Hunt Brothers is around 100 million ounces of silver.

This staggering amount was valued at an even more shocking number which allegedly hit an estimated $4.5 billion as of 1979. The efforts of the Hunt Brothers eventually led to them controlling around a third of the entire global supply of silver which was not controlled by governments — virtually, cornering the silver market was in their grasp and not a moment too soon.

Why Did They Buy Silver?

Now one of the biggest questions to come out of the Silver Thursday fiasco is why the Hunt Brothers set their eyes on the silver in the first place. What was so special about the precious metal that the wealthy siblings would go to extreme heights financially in order to secure a chunk of the market?

Well, the reason behind the heightened interest in silver alone was the brothers’ perception that the commodity would be a safety net during the time when fears of a volatile economic future for the American market were at an all-time high. With inflation surging during the 1970s the brothers sought to protect their wealth by investing in an asset that would be inflation proof.

To provide a bit of context, the fortune left to the Hunt Brothers by their wealthy father shortly after he passed away was diversified into several other investments besides silver such as horses, soybeans, and oil.

During this time, the US market was also facing several issues brought about by excessive war spending and fiscal policies that did not bring any significant improvements in the economy of the country.

In the period spanning from the 1960s all the way to the 1970s, the Hunt Brothers firmly held on to the belief that the economic future of America is headed towards doom and disaster. The growing worries of the Hunt Brothers burst out into more unimaginable heights because of the declining status of paper money or ‘fiat currency’ and the complete abandonment of the gold standard by President Nixon in 1971 which came decades after former President Franklin Roosevelt’s prohibition on the ownership of gold by American citizens in 1934, following the Gold Reserve Act.

Nelson Hunt in particular led the charge of the siblings in aggressively capturing the silver market due to the impending fears of their purchasing power declining given the unfavorable circumstances battering the stock market back then.

For the Hunt Brothers, silver was the most appropriate alternative to gold; also, the commodity would be the safest option to protect their finances from the perceived downfall of any investment that is related or connected to paper currency.

What Did They Do With The Silver?

And so, with the backing of several sources of finances besides their personal assets such as support from family members and generous funding from a number of banks and brokers, the Hunt Brothers were able to penetrate the market for silver.

Some of the biggest reasons the Hunt siblings were able to convince many investors to invest massive amounts into their silver-capturing attempts were banking on the Hunt family’s reputation to build investor trust and a worldwide effort to convince funders that silver would be the next “safe haven” should the market for fiat currency fall.

This accumulation of the precious metal lasted from the year 1973 to its peak in 1979. Instead of going through the usual trading route for the commodity which was to sell their stockpile of silver contracts that were worth billions of dollars in order to let the market circulate, the siblings had the massive amounts of silver bullions shipped to the country of Switzerland via three Boeing 707 airplanes.

Capturing the staggering amount of silver and locking it away for their own preservation in Swiss vaults, the Hunt Brothers during the time had complete and total control of silver’s market price.

When Did The Hunt Brothers Corner The Silver Market?

After concentrated efforts to collect massive portions of the silver commodity to their possession, the Hunt Brothers were virtually at the top of their game. And cornering the entire market for silver all over the world was actually a certain possibility.

When crunching the numbers, the price of silver on January 1, 1979, was $6.08 per troy ounce based on findings from the London Fix — a global price for precious metals such as silver that is set by the London Bullion Market Association or LBMA.

Fast forward a year later on January 18, 1980, the average price of silver skyrocketed to an astounding $49.45 per troy ounce. The jump in just the span of a year is clocked at an unbelievable 713% increase in value.

During this time, specifically during the last nine months of 1979, the Hunt Brothers were able to acquire their infamous silver asset made up of at least 100 million troy ounces and several futures contracts. Effectively, the siblings had officially cornered the silver market by dominating at least a third of the global supply for the commodity.

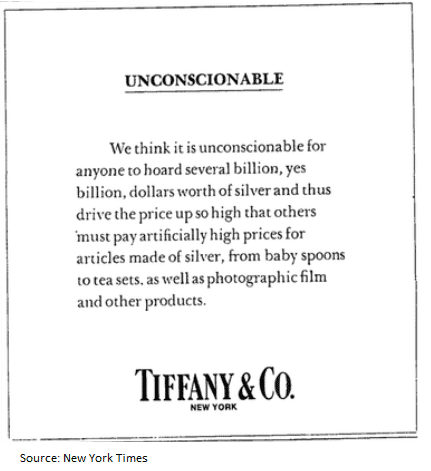

Expectedly, other stakeholders in the market for silver voiced their outrage and concern about the dangers posed by the invasion of the Hunt Brothers. Tiffany’s, a popular American jewelry retailer, even went as far as to block out an entire ad page in the major publication The New York Times to call out the Hunt Brothers.

In the newspaper segment, the company said, “We think it is unconscionable for anyone to hoard several billion, yes billion, dollars' worth of silver and thus drive the price up so high that others must pay artificially high prices for articles made of silver.”

Why Did The Hunt Brothers Fail

However, as they all say, all good things eventually come to an end — well, at least for the Hunt Brothers. The rest of the market was not too keen on the idea of the price of silver being artificially manipulated due to perceived “shortages” in supply for the commodity.

While the notoriety of the siblings and their silver market cornering plans continue to grow, the straw that finally broke the camel’s back was when the United States government looked into the blatant hoarding of silver masterminded by the Hunt Brothers.

The case of the siblings looked all the more unappealing in the eyes of the American government especially because they enlisted additional financial assistance from investors in the Middle East as well during the initial phase of their plans.

The first signs of the end of the Hunt Brothers’ reign emerged on January 7, 1980, when the COMEX introduced ‘Silver Rule 7’, which placed heavy restrictions on the margin requirements for futures concerning the silver commodity.

This move eventually led to a drastic fall in the price of silver in the coming days. The Hunt Brothers had to borrow large amounts in order to offset the growing losses they began to incur.

While the price of silver continued to drop, even reaching as low as a 50% decline in just the span of four days, the Hunt Brothers soon began to realize that they were starting to miss out on some of their financial obligations. The aggressive manipulation of the silver supply through shady tactics spelled failure for the siblings.

Silver Thursday

After experiencing several months of financial downfall upon financial downfall, the momentous Silver Thursday event was finally approaching for the Hunt Brothers and the entire market. The favorable credit that was being offered to the siblings by the banks and brokers they partnered with vanished into thin air.

The Hunt Brothers also had to pay up for the huge amounts of futures in silver that they aggressively collected during the peak of their schemes. The siblings desperately tried to patch up their losses by selling off their silver assets before the price drops even further.

They also had to find more financial backers as well in order to gain funds — not to hoard even more silver, but this time around, it’s to make up for their huge losses. Silver Thursday eventually arrived on March 27, 1980, when the Hunt Brothers missed their first-ever margin call to the brokerage firm Bache Halsey Stuart Shields which was worth $100 million.

In total, the Hunt Brothers were facing a loss of around $1.7 billion. The revelation of this financial upset for the siblings spilled over to chaos in the markets especially silver which experienced a sharp downturn.

Gold was one of the commodities that were also affected by the rollercoaster prices of silver and the stock market of the United States fell into a panic which proved as a threat to the already weak economy of the country brought about by several wars and other legal complications.

Aftermath

It was clear that the endless debts that the Hunt Brothers had to settle due to their failures in the silver market will not be paid anytime soon. However, the siblings were fortunate enough to have their reputable Hunt family name as a last resort.

Many financiers and banks pooled in together a credit line for the siblings that amounted up to $1.1 billion in order to prevent the market from collapsing altogether. However, they did not escape the many charges and lawsuits that came their way such as a $134 million suit against a Peruvian mining company that was directly affected by their aggressive accumulation of silver.

Nelson, who died in 2014, sold off most of his assets such as a stable of thoroughbred horses. William explored other businesses. And Lamar became a prominent figure in the American Football League which eventually evolved into the National Football League.

Silver Thursday remains to be one of the largest market corrections that the United States has experienced in recent times. The experience serves as a valuable lesson on the dangers of even attempting to corner the market and falling down too deep in the dark abyss known as greed.

Despite the failed attempt of the Hunt Brothers to corner the silver market, recently retail traders have also tried to create a silver short squeeze.